Historic Preservation

Epsilon’s historic preservation consultants are respected and trusted professionals in the historic preservation field with a unique understanding of preservation standards, regulatory requirements, and agency expectations.

Historic Preservation Services

- Section 106 compliance

- Local and State historic resource regulatory reviews

- State and Federal Historic Rehabilitation Tax Credits

- Preservation planning

- Historical research and documentation

- Architectural design review

- National Register of Historic Places nominations

- Archival photographic documentation

- Strategic planning and due diligence

Historic Preservation across the Northeast

We are experts at interpreting and implementing local, state, and federal regulations and guidelines affecting historic redevelopment and rehabilitation projects. These include Section 106 of the National Historic Preservation Act, Section 4(f) evaluations, the Massachusetts Historical Commission’s Chapter 254 Review, and Boston Landmarks Commission’s Design Review and Article 85 Demolition Delay reviews, as well as the National Environmental Policy Act (NEPA) and the Massachusetts Environmental Policy Act (MEPA).

Read about all our historic preservation projects.

Our consultants provide insight and guidance to project teams for securing project approvals and clearances from agencies such as local historical commissions, historic district commissions, State Historic Preservation Offices, and the National Park Service. All members of our historic preservation team exceed the Secretary of the Interior’s professional qualification requirements providing developers and owners with guidance to comply with the Secretary of the Interior’s Standards for the Treatment of Historic Properties.

Working Together to Preserve History

We often collaborate with project teams on a diverse mix of real estate and infrastructure projects involving historic resources providing strategic regulatory guidance to ensure thorough and prompt approvals.

Through our close working relationships with the staff of local historic boards and commissions, the Northeast State Historic Preservation Offices, and the National Park Service we are able to deliver project approvals in a timely and efficient manner.

Historic Tax Credits

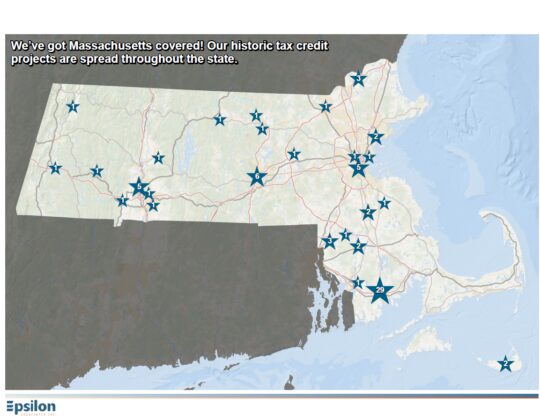

Our highly respected historic preservation professionals have secured state and federal historic rehabilitation tax credits for hundreds of projects throughout the Northeast. Securing state and federal historic rehabilitation tax credits for our clients helps to finance the rehabilitation, renovation, and adaptive reuse of historic buildings breathing new life into otherwise underutilized or abandoned buildings.

Our team expertly secures state and federal historic tax credits for our clients.

In addition to securing the federal historic rehabilitation tax credit, our team has particular expertise in obtaining state historic tax credits including the Massachusetts Historic Rehabilitation Tax Credits, Connecticut Historic Rehabilitation Tax Credits, Rhode Island Historic Preservation Tax Credits, New York State Rehabilitation Tax Credits, and Maine Historic Rehabilitation Tax Credits (both the Substantial and Small Project Rehabilitation Credit).

Any Questions?

Douglas Kelleher

Principal

Historic Preservation Planning & Tax Credits

978-461-6259 dkelleher@epsilonassociates.com

Brian Lever

Associate

Historic Preservation Planning & Tax Credits

978-461-6261 blever@epsilonassociates.com